The drop in mortgage rates to below 7% is good news for prospective homebuyers but unfortunately, there’s now a new challenge. It may be harder to qualify for a mortgage.

The Mortgage Bankers Association (MBA) reports mortgage availability decreased in December. That means there was less money to lend.

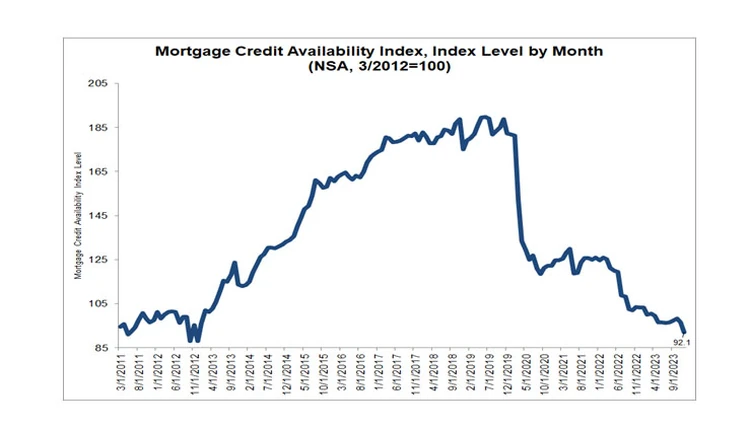

“Credit availability declined in December to the lowest level since 2012, as ongoing industry consolidation is resulting in more loan programs being removed from the marketplace,” said Joel Kan, MBA’s vice president and deputy chief economist. “Both conventional and government indices experienced decreases. The decrease in the government index was driven by lower investor demand for renovation loans and streamlined refinance loans.”

The Mortgage Credit Availability Index (MCAI) is the tool that tracks mortgage activity. In December, the index dropped 4.6% to 92.1. The index was benchmarked to 100 in March 2012.

The Mortgage Credit Availability Index (MCAI) is the tool that tracks mortgage activity. In December, the index dropped 4.6% to 92.1. The index was benchmarked to 100 in March 2012.

Bottom line, a declining MCAI means lenders have tightened their standards, demanding larger down payments and higher credit scores. Buyers might have to shop around more to find a mortgage lender they can work with.

If you’re looking for a mortgage lender, this ConsumerAffairs tool might help.

While credit availability was down across the board, it was down most in government lending programs, such as FHA loans. Conventional loan availability declined only half as much.

Photo Credit: Consumer Affairs News Department Images

Posted: 2024-01-11 12:16:25