It's not just a Hyundai-Kia problem

Hyundai and Kia models have acquired a reputation for being easy to steal, thanks to the "Kia Challenge," which enticed social media mavens to try their hand at grand larceny. But in fact, it's the No. 1-selling vehicle in the U.S. that is the most-often stolen.

Yes, we're talking about the Ford F-150 pickup truck. It's been the top-selling truck in the country for more than 47 years. And Fordcars and trucks have outsold every other brand for over 40 years, so with all those Fords out there, it's not surprising a few of them get nicked every year.

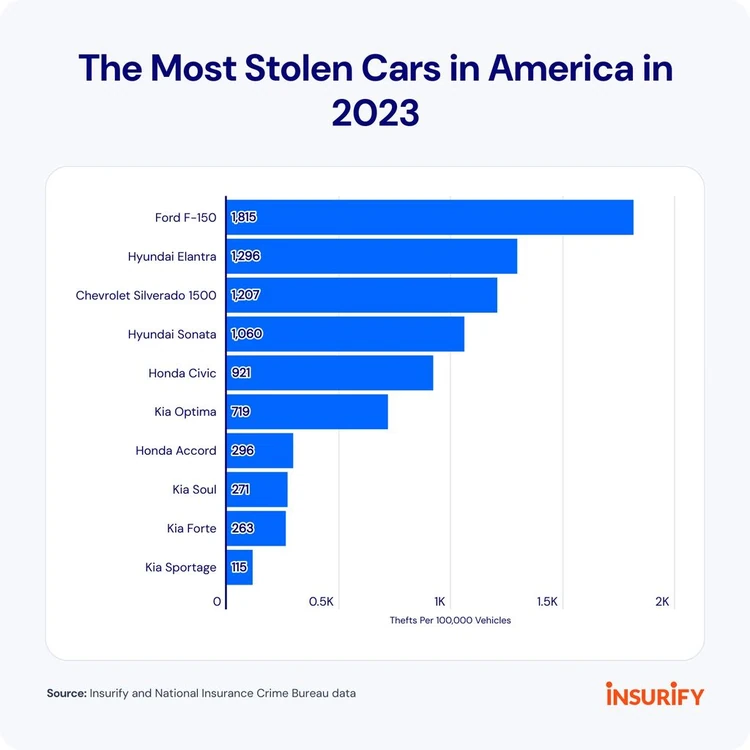

How many? Well, it works out to 1,815 thefts per 100,000 F-150s. The Hyundai Elantra is second with 1,296. Another hefty pickup -- the Chevrolet Silverado -- is third at 1,207, according to Insurify.

Hyundai-Kia models are still in the running but thanks to a quick fix of the feature that made the cars easy to steal, they now are more apt to stay put. If you look just at brands and not individual models, the Koreans still top the list.

How to prevent theft

Unfortunately, you can't completely prevent theft but there are steps you can take to reduce your risk. Here are some suggestions, admitedly pretty obvious ones, from theNational Insurance Crime Bureau:

- Park in well-lit areas.

- Close and lock all windows and doors when you park.

- Hide valuables out of sight, such as in the glove box or trunk.

- Do not leave your keys in your vehicle.

- Do not leave the area while your vehicle is running.

- If your vehicle is stolen, call law enforcement and your insurer immediately because reporting a vehicle as soon as possible after it is stolen increases the chance of recovery.

When reporting your car stolen, you should be ready to provide the following information:

- The make/model of the vehicle, color, license plate number, as well as the vehicles VIN number. (The VIN can be found on your insurance policy documentation or on the Proof of Insurance card.)

- The process for filing a stolen vehicle report to your insurer could be over the phone, online, or even directly to your insurance agent.

Photo Credit: Consumer Affairs News Department Images

Posted: 2025-01-27 19:16:34