Live

France24 English News Live StreamGlobal News

Global News Video PlaylistPBS

PBS News Video PlaylistNewsroom Features

The Honolulu Marathon: A Global Celebration of Running and Culture

See Special Report: The Honolulu Marathon: A Global Celebration of Running and Culture

Published Saturday December 13, 2025

Winter Storm Safety: Protecting People, Pets, and Communities

See Special Report: Winter Storm Safety: Protecting People, Pets, and Communities

Published Saturday December 13, 2025

Inclusive Holiday Gift Guide: Celebrate Christmas, Hanukkah, and Kwanzaa with gifts for People and Pets that warm hearts and paws

See Special Report: Inclusive Holiday Gift Guide: Celebrate Christmas, Hanukkah, and Kwanzaa with gifts for People and Pets that warm hearts and paws

Published Saturday December 06, 2025

Pearl Harbor Day: Honoring the Past, Inspiring the Future

See Special Report: Pearl Harbor Day: Honoring the Past, Inspiring the Future

Published Friday December 05, 2025

Top 10 Joyful Tech Picks for Cyber Monday 2025: Deals That Make You Sing

See Special Report: Top 10 Joyful Tech Picks for Cyber Monday 2025: Deals That Make You Sing

Published Wednesday November 26, 2025

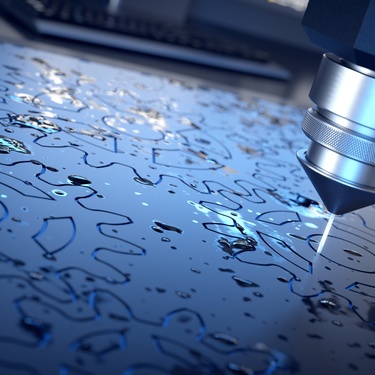

The Best Methods for Precision Metal Cutting

See Contributor Story: The Best Methods for Precision Metal Cutting

Published Saturday December 06, 2025

Upkeep Challenges in Older Urban Architecture

See Contributor Story: Upkeep Challenges in Older Urban Architecture

Published Friday December 05, 2025

Tips for Securing Luggage on Your Car While Traveling

See Contributor Story: Tips for Securing Luggage on Your Car While Traveling

Published Thursday December 04, 2025

Preserving Your Sense of Self in Early Motherhood

See Contributor Story: Preserving Your Sense of Self in Early Motherhood

Published Wednesday December 03, 2025

Off-Roading on Various Terrains: Tips To Help Beginners

See Contributor Story: Off-Roading on Various Terrains: Tips To Help Beginners

Published Tuesday December 02, 2025