Mississippians are most worried

Concerns about inflation are easing among some Americans, but the great majoritystill believethe cost of living has gone up in recent months.

Across the U.S., 84% saidthey think prices of goods and services have increased where they live and shop within two months, according to a survey by the U.S. Census Bureauconducted between May 28 and June 24.

The survey, called the Household Pulse Survey, is a new effort from the U.S. Census Bureau and other federal agenciesto quickly produce insights on social and economic matters, including on health, food and energy. The Census collects the information through 20-minute online questionnaires.

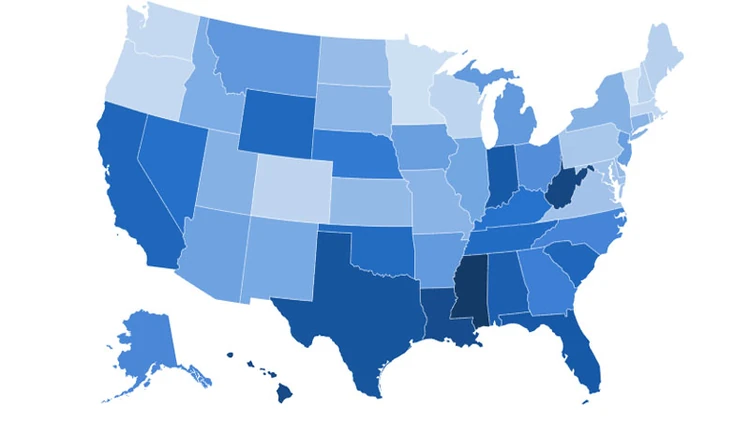

The survey shows more than a third of Americans are having a hard time paying for everyday household expensesand more than three quarters are worriedprices will go up this year. Americans in the Southare even more concerned, while there is less worry in the Northeast and in the West. Twenty states were above the overall 84% of Americans who think prices have gone up where they live within two months.

Here's the top five states with people who think prices have increased:

- 1. Mississippi: 91%

- 2. West Virginia: 89%

- 3. Hawaii: 89%

- 4. Louisiana: 89%

- 5. Texas: 88%

Here's the bottomfive states with people who think prices have increased:

- 50. Vermont: 72%

- 49. Minnesota: 75%

- 48. Washington: 78%

- 47. Oregon: 78%

- 46. Massachusetts: 79%

In a separate question, the Census asked Americans about their household expenses. In the entire U.S, 37% said it has been somewhat or very difficult to pay for usual household expenses in the last week.

In 21 states, there was a higher share of respondents saying they were having difficulty paying for expenses than the overall U.S.Again, Mississippi ranked highest.

Here's the top five states with people saying they are having problems paying usual household expenses:

- 1. Mississippi: 47%

- 2. Wyoming: 47%

- 3. Oklahoma: 44%

- 4. Louisiana: 44%

- 5. Alabama: 44%

Here's the bottom five states with people saying they are having problems paying usual household expenses:

- 50. Virginia: 30%

- 49. Wisconsin: 30%

- 48. Maine: 30%

- 47. New Hampshire: 30%

- 46. Vermont: 31%

The Census Bureau also asked if people wereworried about further spikes in prices. Across the U.S., around 79% said they were somewhat or very concerned that that prices will increase in the next six months.

Twenty-seven states had a higher share ofrespondents concerned about prices increases than the overall U.S.

Here's the top five states with the most concernabout price increases:

- 1. Oklahoma: 89%

- 2. West Virginia: 86%

- 3. Mississippi: 85%

- 4. Kentucky: 85%

- 5. Louisiana: 85%

Here's the bottomfive states with the leastconcernabout price increases:

- 50. Vermont: 72%

- 49. Minnesota: 73%

- 48. Maine: 73%

- 47. New Hampshire: 73%

- 46. North Dakota: 74%

Still, some newnumbers suggest certain costs may be stabilizing or even coming down. In the first six months of this year, there have been small dropsin the prices of fruits and vegetables, nonalcoholic beverages, new vehicles and dairy products.

Price tags on some common grocery items have also largely shown stability and declinesin the first half of 2024.The ConsumerAffairs Datasembly Shopping Cart Index fell 2.7% in June from January. The index, based on average prices of 25 commonly-bought grocery items, was down $4.33, totaling $153.32 in June from $157.65 in January.

Photo Credit: Consumer Affairs News Department Images

Posted: 2024-07-24 12:42:00