Job scams are not exactly as old as the hills, but they have been around at least since 2006 when ConsumerAffairs first reported on a CareerBuilder.com job ruse.

Almost 20 years later, they continue to climb in popularity. That's mostly because the scammers prey on desperate people who are actively looking for work and scammers are always finding a new way to launch a scam – a new social media platform and, now, artificial intelligence (AI).

ID.me? Do you even know about it?

The Identity Theft Resource Center (ITRC) says the newest avenue is asking job seekers for their ID.me login information and other sensitive personal information.

ID.me? Yes. You may not even know that you’re signed up for it, but odds are you have. ID.me is a government-run website that simplifies how individuals prove and share their identity online.

Scammers like shooting at fish in a barrel and ID.me gives them all they want. Altogether, ID.me has 100 million members with over 70,000 individuals joining daily, as well as partnerships with 31 states, multiple federal agencies, and over 500 name brand retailers -- loaded with names, birthdates, Social Security numbers and bank account information.

So big is the ID.me problem that it’s kept the ITRC busier than ever. The ITRC told ConsumerAffairs that it has witnessed a 545% increase in victims, just between December 2023 and January 2024.

What job scams are happening?

Job scammers are living largely off of the phony job listings they’ve posted, mainly on job posting platforms such as Indeed and Craigslist, as well as being told they were scouted for (fake) jobs on LinkedIn.

And because many (most?) Americans don’t value their ID.me information as carefully as they should, identity criminals are asking job seekers for their ID.me login information so the scammers can log in and drill down to other sensitive personal information.

Today's biggest scams

The big job scams of the moment? Well, first, has got to be the focus scammers are putting on soon-to-be college graduates or students looking for a summer gig. And the scammers are playing on the naivete of those students who aren’t thinking about being scammed as much as they’re thinking about getting off mom and dad’s payroll.

“Many of the scammers posing as potential employers or employment services will ask for upfront application fees which, when paid by the job applicant leave the victim of the scam without a job and being cheated out of their money,” warns Scamacide’s Steve Weisman.

“Scammers also will ask for your Social Security number and bank account information so that they can directly deposit your salary check into your bank account. However, they are really seeking your Social Security number to make you a victim of identity theft and your bank account number so they can drain your account.”

Work at home scams are big

Next on the job scam hierarchy are work-from-home scams. The scammers dangle easy, work-from-home opportunities that require minimal skills. Some are taking their craft up a notch, too, by using things like AI-generated headshots to appear to be more legitimate.

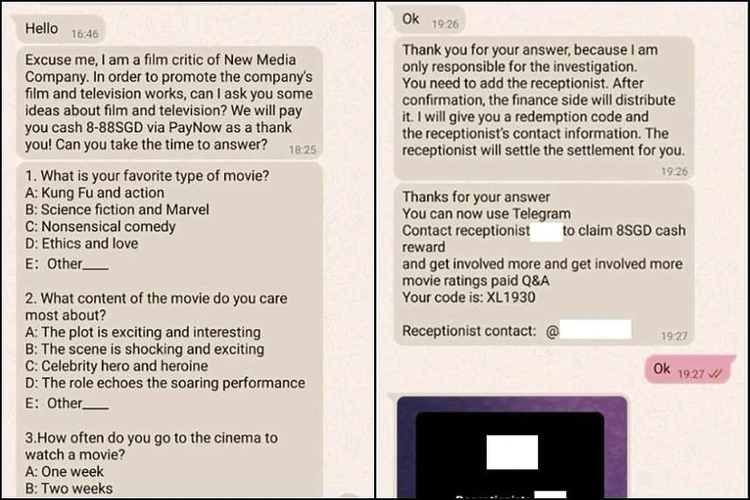

The third easy-money job lure is built around survey and affiliate marketing scams. In this trap, victims are told all they have to do is complete some online surveys or help boost products on e-commerce platforms through affiliate marketing. When they do, they’re supposed to get a small commission, but what they really get is ripped off.

To demonstrate what one of these looks like, the Singapore Police Force – one of the hottest financial and technological hubs on the planet – offers a sample of what it’s caught in action and part of what has led to consumers losing $45.7 million in six months.

The other hot job scam is relatively new, but it’s got the potential to grow because it, too, focuses on college students, but adds in a bleeding heart factor – UNICEF.

The other hot job scam is relatively new, but it’s got the potential to grow because it, too, focuses on college students, but adds in a bleeding heart factor – UNICEF.

Weisman said that scammers are starting to show up as UNICEF reps and are targeting college students with offers of paid internships via email and social media.

But, the line these students are crossing is where they give personal information or pay some sort of application fee.

Unbeknownst to them, UNICEF doesn’t ask for application fees, nor does it post job offers through emails or social media. The only surefire way to find out about – and apply for – a UNICEF position is through its website. or on the websites of its National Committees.

Take steps to stay secure and eep your money safe

ITRC offers these tips to avoid any – and all – online job scams:

Once you find a job posting, be careful how much personal information you share, at least during the application period. Interviews by phone, Skype or Zoom are standard, but if a potential employer asks you to download a separate third-party app, that is a big fat red flag.

Same is true if they initiate the interview through text or email. Do not turn over sensitive personal information like your Social Security number, financial account information or a picture of your driver’s license. Do not send your ID.me login information or log in to an ID.me account that was created for you.

Know the source of the job listing. This requires you to do some research. Look online for independent sources of information. Search the name of the company or the person who’s hiring you and add a word like “scam,” “review” or “complaint.” Searching for “Acme Co Scams” will give you search results showing whether the company is legitimate and has been associated with identity fraud.

Is the website real?

Also, check to ensure you are visiting the company’s real website and receiving an email from the company’s actual domain. Would-be identity thieves have gotten savvy and may replace the letter “I” with the number “1” or add something simple like a “-us” to the end of a website or email address to make it look like you are visiting a company’s legitimate website or receiving an email from a legitimate company.

Legitimate jobs don’t usually require any upfront fees or costs. While things like company uniforms or specialized equipment like steel-toed shoes may be required, it’s typical that the cost of those is deducted from the first paycheck or purchased by the employee through an outside company.

If an employer asks for a finder’s fee, administrative fee, background check fee or other funds, it is probably a scam. Even for legitimate actions like presenting a bank account number and routing number for direct depositing of paychecks, it’s vital to ensure the company is legitimate and the job has already been awarded before submitting the information.

If you think anything seems a little out of place, you can also contact the ITRC and seek its help. You can speak with an expert advisor by phone (888.400.5530) or live chat. Just visit www.idtheftcenter.org to get started.

Photo Credit: Consumer Affairs News Department Images

Posted: 2024-02-29 12:17:27