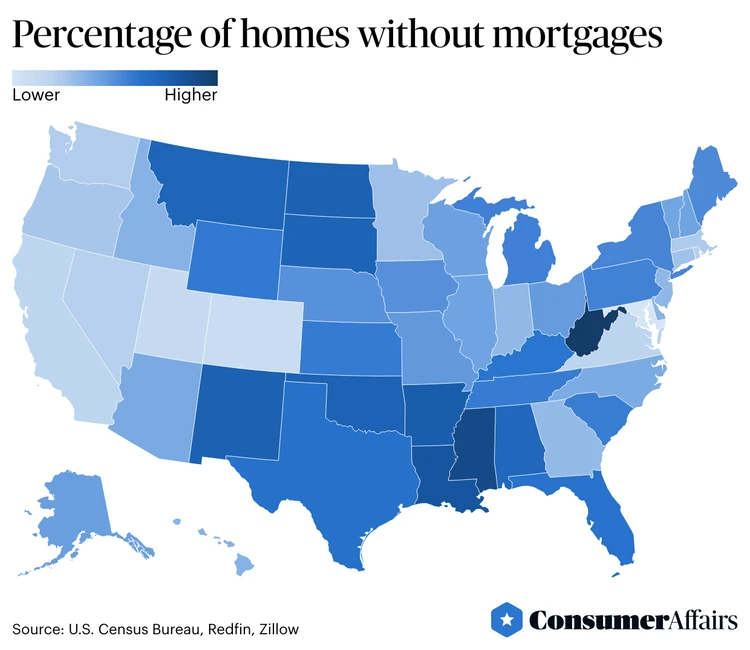

West Virginia, Mississippi, Arkansas, Louisiana and New Mexico. What do these five states have in common?

If you said they have the lowest income per capita in the U.S., you would be partially correct. Four of the five are in that category.

So it might be somewhat surprising that a new study from ConsumerAffairs found another common link among these five states: they have the largest percentage of mortgage-free homes in America. They have the largest percentage of homeowners who don’t make a monthly mortgage payment.

Owning your home free-and-clear is somewhat rare in the U.S., a status that usually isn’t achieved until later in life. Data from the National Association of Realtors (NAR) suggests that around 80% of buyers in the U.S. needed some kind of financing to purchase a home from July 2022 to June 2023.

But in two states – West Virginia and Mississippi – slightly more than 50% of homeowners don’t have a mortgage.

Demographics

Jessica Lautz, NAR’s deputy chief economist and vice president of research, says demographics could be part of the explanation.

“This is likely a factor of home prices and how long the owner has been in the home,” said Lautz. “It is more likely that seniors who have been in their homes for longer periods would be mortgage-free. In areas like Colorado and Utah, which had pandemic-fueled housing booms, there may be more recent home buyers who have not yet had an opportunity to pay off their mortgage.”

In fact, about one-half of mortgage-free homeowners are 65 and older. Another factor is the recent trend of all-cash purchases, especially by people who sold houses in expensive states and moved to these states where prices are lower.

“The U.S. still has tight housing inventory, and when there are multiple offers, the all-cash buyer is likely to win,” said Lautz. “In December of 2023, the share of all-cash buyers was 27% of home buyers.”

Photo Credit: Consumer Affairs News Department Images

Posted: 2024-02-02 12:09:49