Live

France24 English News Live StreamGlobal News

Global News Video PlaylistPBS

PBS News Video PlaylistNewsroom Features

President Trump’s 2026 State of the Union: Key Moments, Party Reactions, and What It Means for the Midterms

See Special Report: President Trump’s 2026 State of the Union: Key Moments, Party Reactions, and What It Means for the Midterms

Published Wednesday February 25, 2026

2026 Winter Games & Paralympics: Global Triumphs, Breakthrough Moments and The Road to the French Alps 2030

See Special Report: 2026 Winter Games & Paralympics: Global Triumphs, Breakthrough Moments and The Road to the French Alps 2030

Published Tuesday February 24, 2026

The Fat Tuesday-Ash Wednesday Connection: From Feast to Reflection

See Special Report: The Fat Tuesday-Ash Wednesday Connection: From Feast to Reflection

Published Friday February 20, 2026

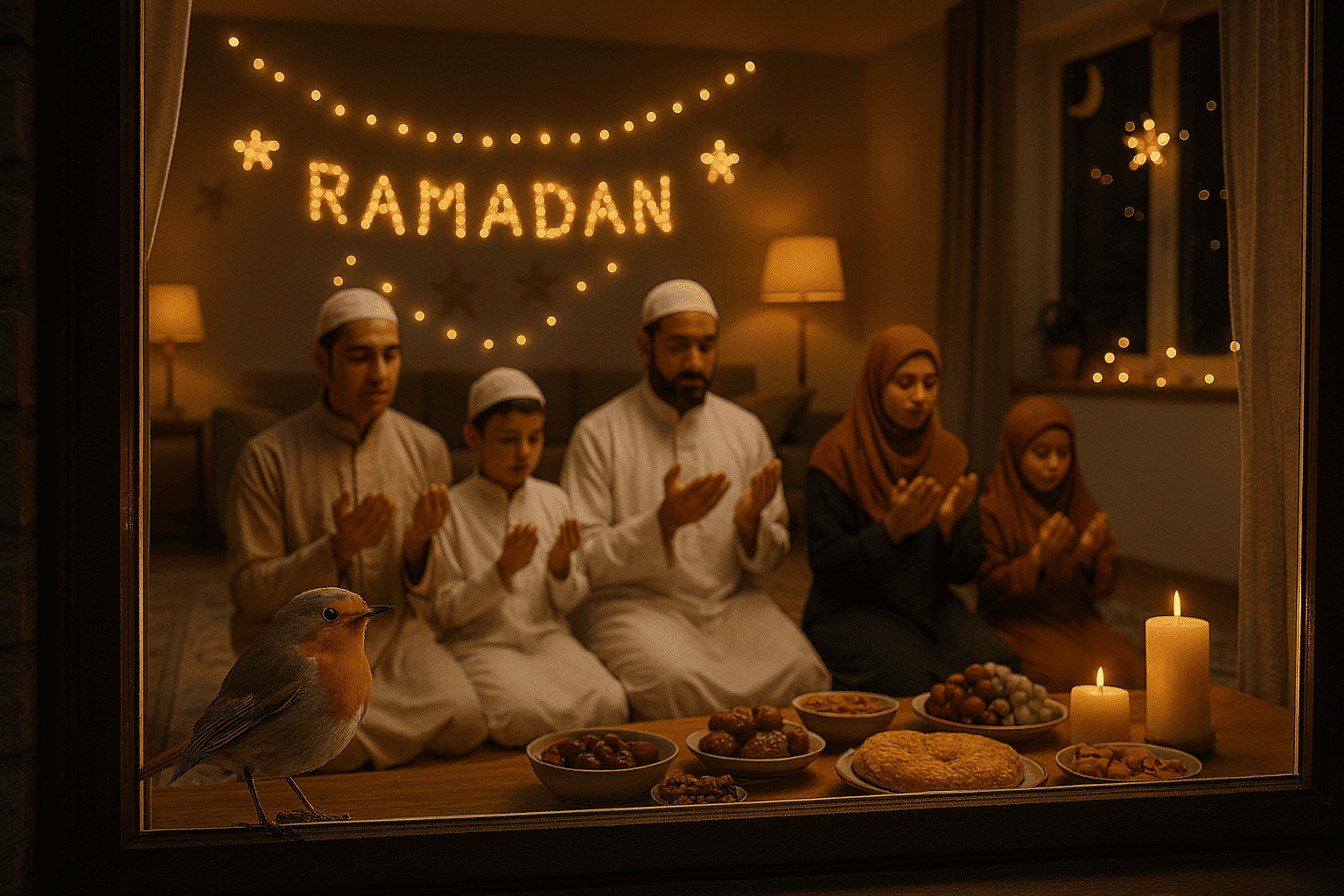

Ramadan 2026: A Month of Fasting, Faith, and Global Community

See Special Report: Ramadan 2026: A Month of Fasting, Faith, and Global Community

Published Wednesday February 18, 2026

Red Neon Chinese New Year of the Horse Sweatshirt — Glowing Stallion Graphic Crewneck

See Special Report: Red Neon Chinese New Year of the Horse Sweatshirt — Glowing Stallion Graphic Crewneck

Published Tuesday February 17, 2026

How to Reduce Wear on Heavy Equipment Parts

See Contributor Story: How to Reduce Wear on Heavy Equipment Parts

Published Wednesday February 18, 2026

Does Your Home Need a Wind-Rated Garage Door?

See Contributor Story: Does Your Home Need a Wind-Rated Garage Door?

Published Tuesday February 17, 2026

4 Fun Ways To Bond With Your Bridal Party

See Contributor Story: 4 Fun Ways To Bond With Your Bridal Party

Published Monday February 16, 2026

Best Practices for Managing Local Business Listings

See Contributor Story: Best Practices for Managing Local Business Listings

Published Sunday February 15, 2026

Common Mistakes Beginners Make in DIY Deck Construction

See Contributor Story: Common Mistakes Beginners Make in DIY Deck Construction

Published Saturday February 14, 2026